Summary

- RC Forward moved $4.4M CAD (~ $3.3M USD) from Canadian donors.

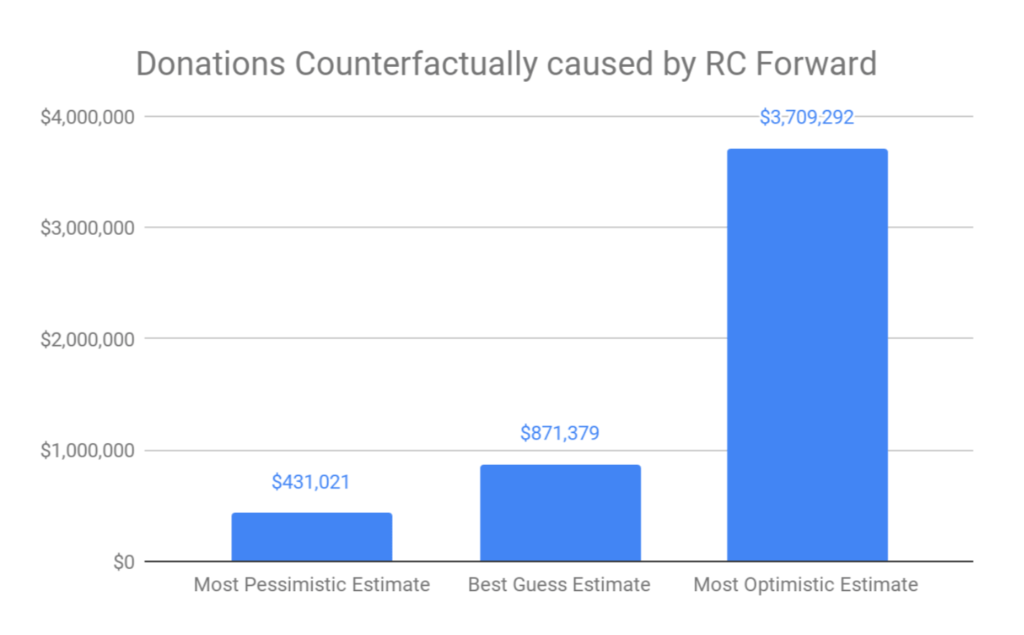

- $430K to $3.7M of donations may have been counterfactually caused by RC Forward.

- RC Forward appears to have increased donations by 11% to 500%, with a best guess of 25% to 35%

- Donating to cover the costs of RC Forward may lead to 3 to 55 times more going to the charities that RC Forward regrants to than donating directly to those charities instead.

RC Forward is a donation platform through which Canadians can make tax-advantaged donations to high-impact charities located inside and outside of Canada. We hypothesized that previously inaccessible tax incentives and fee elimination offered by this service would increase the donation total and individual gift sizes. This post details a cost-effectiveness analysis of RC Forward in 2018 and some reasons to limit the weight put onto any specific numbers.

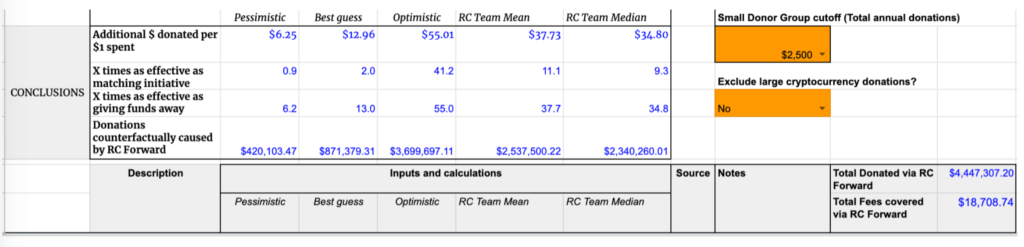

We find that compared to estimates of how much would have been donated if RC Forward did not exist, donations appear to have increased by 11%-500%, with a best guess of 25-35%. Operating with minimal resources during its experimental phase, $3 to $55 more may have been donated for each $1 spent, which offers a potentially large impact for funders who cover RC Forward’s costs. We should be clear that the cost-effectiveness estimates are generally less robust than one expects and are only our approximations of uncertain quantitative parameters, which are potentially subject to bias and error. Much of the uncertainty is reflected in the ranges given, but exact numbers should not be taken as high-confidence precise estimates of the actual value RC Forward.

Counterfactual Value in 2018

The platform outperformed the $1M CAD (~ $770,000 USD) forecasted to pass through in 2018, moving over $4,447,307 CAD (~ $3.3M USD) to RC Forward’s list of EA-recommended charities. The cost-effectiveness analysis detailed below suggests that donations would have been between $740K and $4M if RC Forward did not exist. These estimates place RC Forward counterfactual value produced at between $430K and $3.7M in 2018, on a budget of $67,249.40 This suggests that for each dollar spent by RC Forward, an additional $6 to $55 made it to EA charities, with a best guess of ~$13. The best guess estimate for RC Forward’s counterfactual impact is that ~$870K more was donated, which is a ~25% increase from the $3.5M estimated to have been donated without RC Forward. The graph above illustrates some estimates for the donations counterfactually caused by RC Forward.

We are fairly certain of the counterfactual donation ranges above. However, since two large cryptocurrency donations from a single donor make up 66% of total donations, excluding these unusual donations may offer a more generalisable insight. In this case, EA charities would have received donations of between $554K and $1.3M, compared to actual donations of $1.5 million. Thus, the best guess is that ~$400K more was donated, which is a 35% increase from the $1.1M estimated to have been donated without RC Forward. Omitting the fees covered for the cryptocurrency donations from the cost, this suggests an additional $3 to $16 donated for each dollar spent by RC Forward, with a best guess of ~$7.

As one comparison, the responses to the EA Giving Tuesday Donation Matching Initiative 2018 survey suggest that “$85k (12%) of donations may have been counterfactually caused by the initiative, though this estimate is highly uncertain”. If we assume the $469K in matched donations would not have been made without the EA Giving Tuesday initiative, then it would appear that the increase in total raised due to that program was actually ~88%.

How might covering fees of 4% have increased donations more than matching? Paying to cover the 4% fees is already ‘neutral’ with regards to the total money going to charity even if there is no change in donations. That is because covering the 4% fees of other donors means that 4% more of their donation goes to the charity. Covering their fees specifically is equivalent to donating 4% directly to the charity yourself. If covering their fees increases total donations by X%, the total increase in money going to the charity is X%, not X-4%. The RC Forward figure is far above the 4% in fees covered because our estimates assume donors are incentivized to increase their donation beyond this 4% and because RC Forward makes possible donations that could not otherwise be made by Canadians to EA recommended charities.

Cost-Effectiveness Model

This model estimates a range of how much would have been donated to RC Forward’s list of EA-recommended charities in a world where RC Forward didn’t exist. Readers are encouraged to engage with the model, make use of the dropdown menus and play with the numbers for yourself.

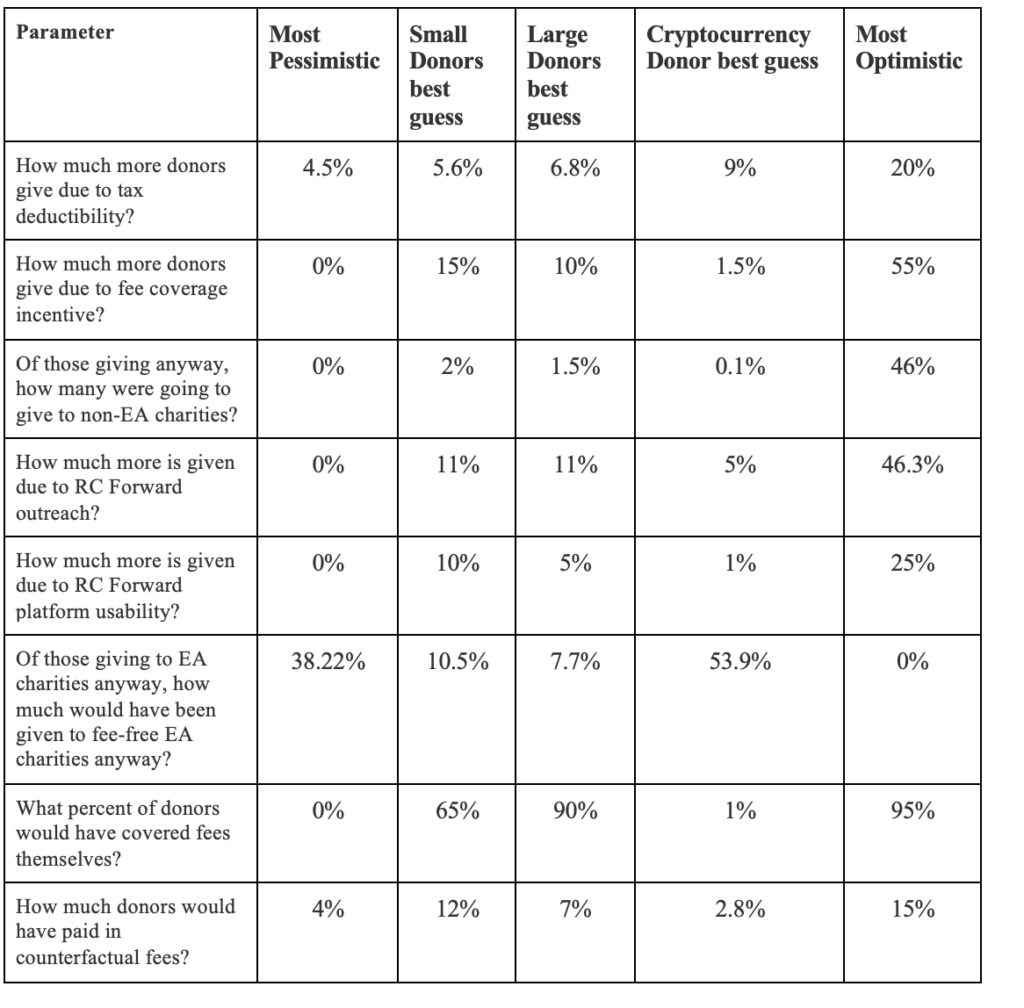

Starting with the actual amount of donations received by RC Forward in a given year, we work backward to imagine a counterfactual donation amount. For each of these parameters, we use a pessimistic, best-guess, and optimistic estimate as well as the mean and median estimates from a number of RC staff, and alter the threshold for judging who is a “small” or “large” donor. This follows a 2016 example of GiveWell’s cost-effectiveness analysis (CEA) for New Incentives but has the effect of producing extreme results (e.g. compounding pessimistic guesses) [1]. Each parameter is explained in detail in the sections below. The parameters in this “funnel” are presented here alongside some effect size estimates (most pessimistic estimate, best guess for small donors, best guess for large donors, best guess for cryptocurrency donors, most optimistic estimate):

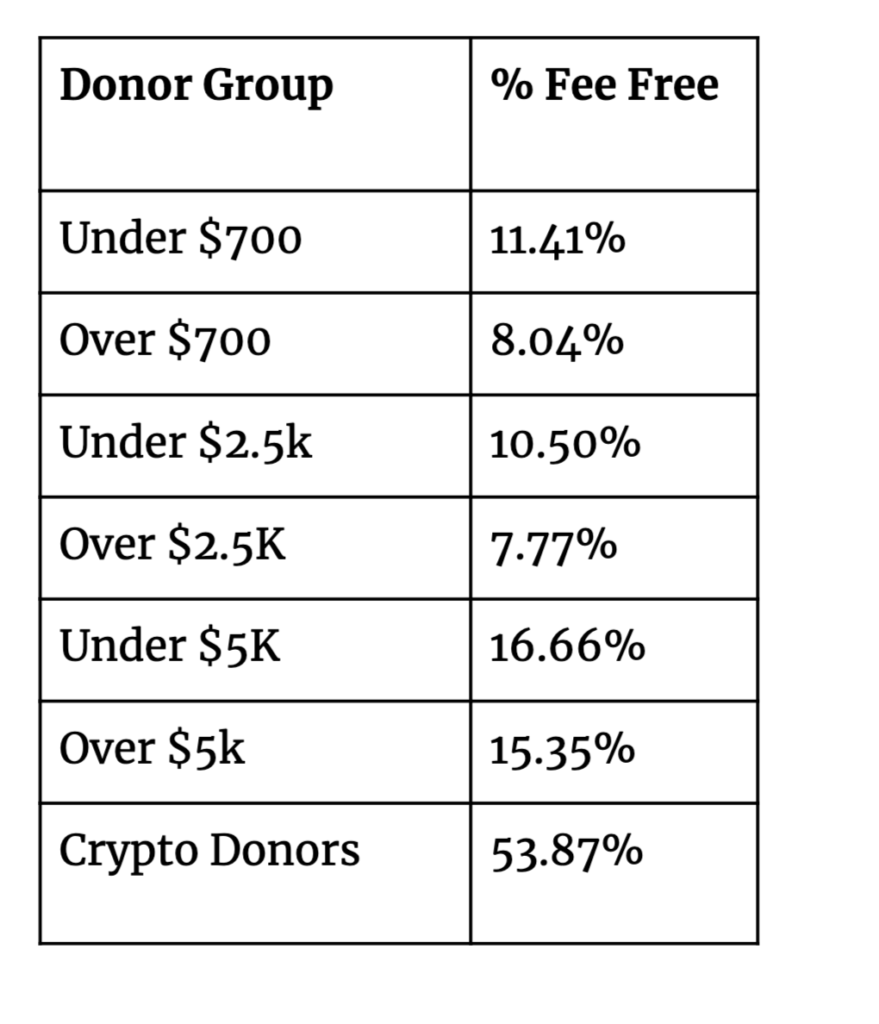

In order to create donor groups, individual donations have been combined into an individual donor’s total donation amount. Small donors are more likely than large donors to be dissuaded from making donations due to an inconvenient donation platform or fees. Among RC staff surveyed, there was not a consensus about what the threshold between these donor groups should be. Therefore, three variations of the threshold have been included in the model. Small donors are those donating in total either: $700 or less (~$60 per month at most), $2,500 or less, or $5,000 or less. Correspondingly, large donors are those donating more than $700, more than $2,500, or more than $5,000. The two cryptocurrency donations are treated as a separate group. The threshold can be selected in a dropdown menu, as well as the inclusion or exclusion of the cryptocurrency donations.

At the moment, this model does not factor in whether RC Forward encouraged intra-EA charity donation switching (e.g. a donor shifting from AMF to MIRI and whether to consider this a positive or negative overall). We treat all charities served by RC Forward as equal. One could plausibly include a “worldview” feature where one can select a “long-termist”/ “near-termist, human-centric”/ “near-termist, animal-inclusive” setting which can alter the parameters or weigh EA charities differently.

Actual Donations & Costs

Total Donations

Total donations moved by RC Forward across the entire time period were $4,447,307.20 ($4,455,628.59 minus $8,321.39 in credit card fees not covered by RC Forward). This includes two large cryptocurrency donations from a single donor: $1,576,358.59 to AMF, and $1,350,000 to MIRI. $487,249.25 came from an existing donor base thanks to Charity Science Foundation of Canada. As these Charity Science entries were bundled together it was difficult to know how many unique donors and donation sizes came via this route. We split the total amount donated via Charity Science to mirror the distribution of small and large donors among the rest of the donations received, excluding cryptocurrency donations.

Total Fees Covered

Total cross-border fees covered by RC Forward for 2018 were $18,708.74. The group of organizations that facilitate RC Forward cross-border donations charge 4% on the first $200,000 of the year across the border and 0.5% on anything beyond that. These cross-border fees do not apply to AMF, IGN or SCI donations as they are qualified donees. Qualified donees are organizations that can, under the Income Tax Act, issue official tax receipts for gifts they receive from individuals and corporations. A registered charity can make gifts/grants only to other qualified donees.

Cryptocurrency donations also incur a brokerage fee of 1% of the monetary value of the securities, or $250 (whichever is greater) before they reach RC Forward. The cryptocurrency donation to AMF wasn’t subject to any cross-border fees (other than the broker fee) as AMF has Canadian charitable status. The cryptocurrency donation to MIRI was subject to the 0.5% cross-border fee so it was $6,750 to move it across the border.

Costs of salaries and other expenses

For 2018, costs other than covering fees totaled $48,540.66. This is closely in line with 2018 projections, but the overall budget of $67,249.40 is lower than expected.

Counterfactual Donations

Incentivizing giving through fee coverage and tax deductibility

An RC Forward document on the value of fee coverage suggests:

The range we estimate for the likely counterfactual increases in donations as a result of fee coverage is between 6% (based on the influence of removing fees being only slightly greater than the impact of making donations 4% cheaper via tax benefits and slightly greater than our most pessimistic expert estimate were it the case that other charities were also charging equivalent fees) and 20% which is the upper limit of most of our expert estimates, with our best guess being around 10-15% in line with our expert estimates. However, we assign a significant (though only ~10% probability) to the impact being substantially higher than this, in line with the most optimistic expert projections (55%).

A meta-analysis of the influence of the price elasticity of donations, in terms of how much more donors give when tax breaks make their donation ‘cheaper’ suggested that on average, a 1% reduction in the cost of charitable giving (i.e., an increase in the charitable deduction) can be expected to provide an increase in donations of 1.44%, though note that when outliers were removed this was only 1.11%. If this applied mutatis mutandis to the influence of removing transaction fees on donations, then covering 4% fees would increase donations of 4.44-5.76% while also ensuring that all donor money went to the charities.

For those who are aware of the tax deductibility of donations, the savings they make could be included in the overall value of RC Forward. However, this is hard to estimate since it requires guessing how many people would donate anyway to the same organisation but in a non-deductible fashion. For the moment this is omitted, but future surveys of donors may allow this to be calculated.

The change from giving to non-EA charities to EA ones.

What percent of donations were going to EA-recommended versus non-EA charities in any case? In other words, what percent of the donor market share is RC Forward capturing? Conversations with RC staff suggest at the moment this is likely to be quite small. GiveWell estimates it directed $149 million to its recommended charities in 2017. This is less than 1% of the $49 billion received by the 100 largest charities in the USA in 2018 suggesting only a tiny fraction of donors are diverting funds to EA charities. Surprisingly, there does not appear to be a recent EA source on how much money has been moved to all EA-recommended charities either in a given year or since the EA movement began. In the absence of more precise data from donor surveys, we assume RC Forward captured only a small percent of Canadian donors who were planning to donate to non-EA charities and then switched because of RC Forward’s existence. Estimates for this parameter range from 1% to 46% of small donors and 1% to 18% of large donors switched from a non-EA Canadian charity to an AMF, GiveDirectly, etc. For the cryptocurrency donor, we guess someone giving over $1 million dollars to AMF and MIRI is likely well acquainted with the EA community and convinced by effectiveness arguments, so has a ~0% chance to give to a non-EA charity. Our best guesses assume 95-100% of donors were planning to give to EA charities anyway.

Fee-Free EA charities

Of those giving to EA charities, what percent would give to qualified donees for which a cross-border fee wouldn’t apply? Conversations with RC staff suggest that some donors approached them with specific charities in mind and then opted to distribute their donation across a range of charities or to one of the RC Funds, some of which include charities for which a cross-border fee applies. We looked at what percent of RC Forward donations went to AMF, IGN or SCI [2], which are qualified donees and aren’t subject to a cross-border fee, and broke this down by donor group. These may be conservative estimates since perhaps more donations would have been made to fee-free charities without RC Forward encouraging a wider distribution. The percent of all donations going to these “fee-free” charities was 38.22%. This is set as the pessimistic scenario. The optimistic scenario is set as only 5% of donors would have given to fee-free charities. Just over half of the cryptocurrency donor’s contributions went to fee-free AMF, but the model estimates the MIRI and AMF donations separately. Fee-free percentages of donations for each of the donor groups are estimated as follows:

The additional donors giving due to RC Forward platform usability & outreach

All three of these studies (Nielsen, 2009; Ralston, 2014; webcredible) suggest a 10% increase in donations due to an improved user design. We assume RC Forward is on the more user-friendly end of the spectrum. Given the low quality of these studies, the lower bound is 1% and the upper bound is 25%.

What percent of donors would have given without outreach from RC Forward? There does not appear to be a service similar to RC Forward that Canadian donors could avail of instead. One reading of this is that a high percentage of donations would simply not have been made at all but for RC Forward. It may also be informative to look at how many donations have been made since the service moved from Charity Science to Rethink Charity. 11% of all donations came from the existing donor base provided by Charity Science. It seems unlikely to think the other 89% of donations are due to RC Forward outreach. Estimates are the lowest and highest counterfactual estimates offered by the RC Team (1% and 40% for small donors, 1% and 25% for large donors), with a best guess of 11% mirroring the Charity Science contribution. RC Forward themselves write “we were unable to attend to Canadian donors as much as we would have preferred”. However, the value of correspondence with RC Forward staff may be much higher for cryptocurrency donors since RC Forward do note

~$2.9m came from a single donor in the form of two cryptocurrency donations to MIRI (~$1.3m CAD) and AMF (~$1.6m). The latter was only referred by RC Forward. Though we did not handle this donation directly, it is unlikely the donation would have been made otherwise.

However, we are somewhat skeptical that such a donor would actually not have found a way to make a similarly large donation through other means or donation swapping.

Those who would have covered fees themselves

This parameter adjusts to account for the percent of donors who would have paid the cross-border fees themselves so that the charity received 100% of the donation in any case. This is different from the incentive that comes from RC Forward covering the fees. Consider two populations, one who would never donate unless fees were covered, and another who would donate in any case but the amount they donate is conditional on fee coverage. While for the latter there is an amount they would donate if fees were covered and an amount if not, for the former there is only the amount they donate if fees are covered, otherwise they do not donate at all. Fee coverage can both increase the number of donors and the size of donations.

Estimates for this percentage come from marketing blogs (Lake, 2014; Cassandra, 2017; Fluke, 2018). These sources suggest from marketing trials (not peer-reviewed or published in academic journals as far as we can tell) of using opt-out or opt-in options for donors to cover fees, that between 40% and 95% of donors would cover the cost of fees themselves so 100% of intended donation makes it to charity. This seems plausible since it is almost the inverse of the 4% to 55% increase we expect from fee coverage incentivization. This is modeled to be even higher (between 90% and 100%) among larger donors for whom the cost of fees is likely not a significant financial issue. Cryptocurrency donors receive lower estimates for this parameter (0% to 21%) because these donors likely have a fixed amount they are able to donate and will only spend that amount, irrespective of how much makes it to the charity and how much would have been used in fees.

Counterfactual Fees

Once incentive effects (fee coverage, RC Forward outreach, etc) have been removed, the fees that would have been charged on the counterfactual donation are calculated. According to RC staff, without RC Forward’s negotiated rate (based, among other things, on volume) a donor would be charged a cross-border fee of 12% on small donations and 7% on larger donations. It seems plausible that very large donors may have found other options to bring the fees down to the 4% rate that RC Forward has secured.

In the case of the cryptocurrency donations, another broker would have charged 2% of the transaction as their exchange fee, and the platform would have charged 1.8% as their administration fee. Even in the case where RC Forward exists, cryptocurrency donors pay a 1% broker fee before the money comes to RC Forward. The AMF donation is unaffected since no cross-border fee would have been charged in either case. The MIRI donation incurs a 2.8% counterfactual fee.

RC Forward’s platform provider charges a small credit card fee for online donations. Depending on the credit card, this is somewhere between 2% and 3%. In total, $8,321.39 (~0.19% of received donations) went to credit card fees. RC Forward does not cover credit card fees. These fees were not included until the end of the analysis because the data did not separate these fees by individual donor. A 0.19% deduction is taken from the total counterfactual donations.

Limitations

The added value from this project is incentivizing donors to give more than they otherwise would by saving them money via tax-advantaged donations, reduced fees, and optimized processing arrangements. The range of estimates generated by this cost-effectiveness analysis suggests that this has been the case for Canadian donors in 2018. However, there are reasons to limit the weight put onto this analysis.

Many of the estimates could be improved by surveying donors, especially since the high number of anonymous donors clouds the distribution of small versus large donors. Only ~5% of total donations came from named donors. The remainder were made by anonymous donors, which makes calculating the number of unique donors impossible. 66% of donations came via one anonymous cryptocurrency donor. It is unclear how many unique donors are included in the Charity Science existing donor base bundles, which total $487,249.25 (10.94% of total). This has been mitigated against a little by splitting Charity Science donations into buckets mirroring the distribution of small and large donors, excluding cryptocurrency donations. The remaining anonymous donors contributed $781,948.96 (17.58% of total) and it is impossible to know how many of these 226 were unique donors and how many were the same person.

Some of the sources from which estimate ranges were gathered are not gold standard academic studies, and so we could benefit from more research in this area. Estimates for what percent of donors would have covered fees themselves come from online articles/marketing blogs, (Lake, 2014; Cassandra, 2017; Fluke, 2018) and we are unsure how reliable they are. Just as in academic articles, it is plausible to think publication bias leads to more blogs about surprising and interesting findings rather than non-findings on the effects of fee coverage.

Since this analysis covers only one year of RC Forward’s operations we do not have a good sense of how typical the donations are, especially with regard to the two large cryptocurrency donations.

The wide intervals reflect how uncertain we are but model uncertainty can be very high so it is possible even small changes in assumptions or omissions of crucial considerations could change estimates by a large factor. These errors are more likely in less established domains, of which this may be one. This gives us reason to think that our analysis has only narrowed the range of possible values for the counterfactual value of RC Forward.

Conclusions

There are reasons to believe RC Forward is a highly cost-effective program. It appears to have capitalized on demand in Canada for tax-advantaged donations. Based on the results outlined here, leveraging the know-how from RC Forward’s experience so far and replicating this model internationally could compound its value further.

Based on the donations that may have been counterfactually caused by the program, donating to RC Forward may be between 3 to 55 times more effective than donating directly to the EA charities which RC Forward regrants to, given flat assumptions about relative cost-effectiveness of the charities. RC Forward’s conservative proposition was if RC Forward paid to cover the 4% fees (at least up to a certain limit) and donations increased by >4% it would seem to be a net gain. Taking into account not only the impact of fee coverage but a wider range of related and knock-on effects of the platform RC Forward appears to have increased donations by 11%-500%. Even the lower bounds of the ranges offered here seem to offer added value for those interested in covering RC Forward’s costs.

Endnotes

[1] Guesstimate was not very amenable to these calculations because so many of the figures are conditional upon one another so the models produce amounts far in excess of actual donations, or even negative amounts. These figures seemed beyond the bounds of reasonable prior expectations.

[2] The two donations to GAIN and the Malaria Consortium were also included as they went through GiveWell and were subject to cross border totals, but they had no credit card fees as they were given via cheque. The total donated to these charities was only $585 so it does not have a large impact on final figures. SCI is not technically a Canadian charity but is a qualified donee by virtue of being part of a university that some Canadians go to.

References

Cassandra, Adam. 2019.“Will Online Donors Really Cover Transaction Fees?” Lawrence Direct Marketing. http://lawrencedirect.com/ldmi-blog/168-will-online-donors-really-cover-transaction-fees.html (May 20, 2019).

Fluke, Allyson. 2018. “40% of Donors Are Extra Generous – Here’s Why!” Frontstream. https://www.frontstream.com/blog/donors-pay-the-fee-data (May 20, 2019).

Lake, Howard. 2014. “95% of Donors Cover Charities’ Transaction Costs on Blackbaud Heroix.” UK Fundraising. https://fundraising.co.uk/2014/04/17/95-donors-cover-charities-transaction-costs-blackbaud-heroix/ (May 20, 2019).

Nielsen, Jakob. 2009. “Donation Usability: Increasing Online Giving.” Nielsen Norman Group. https://www.nngroup.com/articles/donation-usability/ (May 20, 2019).

Ralston, Danica. 2014. “The Positive Impact of Good UX on Non-Profits | UX Magazine.” UXMagazine. https://uxmag.com/articles/the-positive-impact-of-good-ux-on-non-profits (May 20, 2019).

Webcredible. “Charities Aid Foundation.” https://www.webcredible.com/case-studies/non-profit/charities-aid-foundation/ (May 20, 2019).

Updates

The final bullet point in the summary previously stated “Donating to RC Forward seems between 3 to 55 times more effective than donating funds directly to the EA charities which RC Forward regrants to”. It was amended, after a helpful comment from Darren McKee, to the current text to clarify that it refers to donating to rather than through RC forward.

Credits

This essay is a project of Rethink Priorities. It was written by Neil Dullaghan. Thanks to Siobhan Brenton, Baxter Bullock, David Moss, Marcus Davis, Peter Hurford and Tee Barnett for comment and Marisa Jurczyk for data analysis assistance. If you like our work, please consider subscribing to our newsletter. You can see all our work to date here.