Summary

Since launching in late 2017, RC Forward has onboarded 25 effective charities and initiatives to the RC Forward platform, hired a full-time project manager, and facilitated the movement of $4,447,307.20 CAD (net) to high-impact charities.

Rethink Priorities recently published a cost-effectiveness analysis (CEA) of RC Forward, estimating that donations toward building and servicing the RC Forward platform have a counterfactual impact of 3x to 55x the value of donating directly to our partner charities.

This post outlines below our activities, lessons learned and plans for RC Forward in 2019.

RC Forward Overview

RC Forward is a donation platform through which Canadians can make tax-deductible gifts to high-impact charities located inside and outside of Canada. Absent the platform, Canadians would be unable to donate tax efficiently to over 20 high-impact charities recommended by GiveWell, the Open Philanthropy Project, Animal Charity Evaluators, Founders Pledge and The Life You Can Save. The platform gives donors the affordance to support each respective charity, or give through funds that largely adhere to allocation recommendations made by selected evaluators. Every donor receives a Canadian tax receipt for gifts routed through RC Forward. We’ve also added the options to donate affordably via securities, such as cryptocurrency.

Table of Contents

- Our Year in Numbers

- Early Difficulties

- Responding to Feedback

- Plans Moving Forward

Our Year in Numbers

Below are gross figures for money moved by each of the RC Funds:

- The Global Health Fund distributed $570,876.06 CAD in a 70/30 split to the Against Malaria Foundation and Schistosomiasis Control Initiative per GiveWell’s recommendations.

- The Human Empowerment Fund distributed $64,809.86 CAD to GiveDirectly per GiveWell’s recommendation

- The Animal Welfare Fund distributed $64,112.30 CAD to Animal Equality International ($18,536.74), Good Food Institute ($17,590.90), Humane League ($16,408.59), and Albert Schweitzer Foundation ($11,576.08) per ACE’s instructions.

RC4 Cost-effectiveness

- RC Forward moved $4.4M CAD (~ $3.3M USD) from Canadian donors.

- $430K to $3.7M of donations may have been counterfactually caused by RC Forward.

- RC Forward appears to have increased donations by 11% to 500%, with a best guess of 25% to 35%

- Donating to cover the costs of RC Forward may lead to 3 to 55 times more going to the charities that RC Forward regrants to than donating directly to those charities instead.

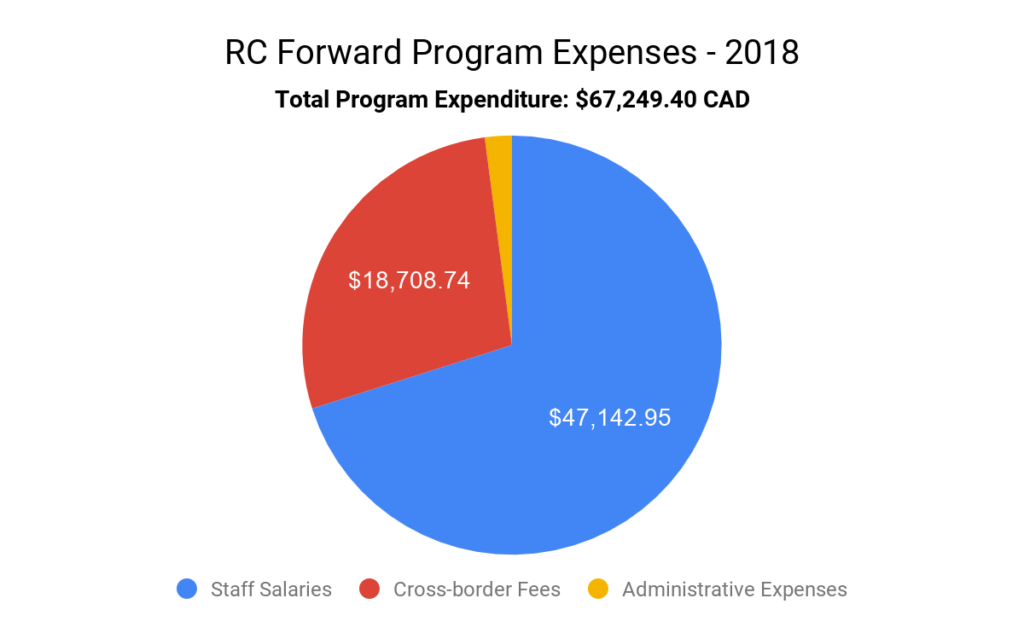

RC Forward is powered by donations

Staffing costs, cross-border fees and overhead expenses are covered by direct donations and institutional grants. We do not charge any administrative fees for our services.

Early Difficulties

Like all startups, we encountered a steep learning curve in our first year of operations, and have been continually growing and updating our program to maximize efficiency and cost-effectiveness.

1. Charity Registration Process

The Charities Directorate in Canada states it takes up to 6 months to register a charity. Our registration process ended up taking 15 months, from November of 2017 to February 2019. This process took much longer than anticipated and would have been extremely difficult without legal guidance from our law firm Blake, Cassels & Graydon LLP. Our recommendation for other initiatives is to seriously consider soliciting pro bono assistance from domestic law firms specializing in relevant domains before embarking on time-consuming bureaucratic processes.

2. Donation Distribution Logistics

To reduce credit card fees where possible, we provided multiple direct donation avenues for Canadian donors. Because we worked with a variety of partners to make this a possibility, the quarterly turn-around for distributions took an average of 8 weeks to process. Sending mail between Canada and the United States caused a lot of variation in expected delivery times. To reduce administrative time associated with following up cheque arrivals, we moved to a postal-tracking system after Q2. In order to mitigate the unique challenges and costs when dealing with two national postal services, we moved to a wire based system in Q1 of 2019.

3. Tax Receipting Efficiency

Tax-receipting was automatic for all donations made online via our online platform. However, all fee-free donations were subject to manual receipting procedures when originating from our fiscal sponsor. We would have greatly benefited from automated receipting software to send and store all of our donation receipts in 2018. We are now beta-testing our proprietary software to manage this for all future donations. This service will also come with a summary function that will send an annual report to donors during tax season to ensure there is a reliable and accurate paper trail for all parties.

Responding to Feedback

Our last public update generated valuable feedback on how we could improve our platform.

We have since added EA Funds and the Centre for Effective Altruism to our platform as a result.

We examined the viability for adding an operations ‘tip’ function, similar to GiveWell, but have been experiencing technical challenges integrating this with CHIMP’s infrastructure. Nevertheless, we will be keeping this in mind as a key design feature.

Plans Moving Forward

1. Leading effective charity registration in Canada

We have plans to help a well-known effective charity obtain charitable status in Canada, and we are considering this strategy as a broader initiative for other effective charities.

2. Engaging corporate donations and employee matching programs

We are working with Benevity, a popular corporate donation and matching tool, to ensure our partner charities are available for Canadian employee matching programs. Thanks to Telus Communications and a generous employee, our first match secured $10,000 CAD for GiveDirectly in early 2019.

3. Improving the donor experience

In addition to implementing automated tax receipting, we are currently building a new website for RC Forward that will be optimized for giving donors a smooth experience.

4. Increasing distribution transparency

Inspired by the allocation and email notification system that Against Malaria Foundation uses to track bednet distribution, we are aiming to design a system that will provide a tracking mechanism for individual donors to see when donations have been gifted to their charities of choice.

5. Researching how to market effective giving to Canadians

How do we convert donors to high-impact giving? What unique challenges or benefits exist in marketing effective giving to Canadians? We are currently reaching out to all of our partner charities to help them maximize awareness that they can receive tax-deductible gifts from Canadians via RC Forward.

This post was written by Siobhan Brenton. Thanks to Tee Barnett, Baxter Bullock, Simmo Simpson, Neil Dullaghan and David Vatousios for comments. If you would like to discuss RC Forward in more detail contact us at [email protected].

RC Forward (legal entity Rethink Charity Foundation 793187881RR0001) is a Canadian Registered Charity and Non-Profit society based in Vancouver, Canada.

RC Forward is a project of Rethink Charity.